Posted on: Jan. 7, 2026

Press Release

Unveils Product Enhancements Strengthening KYT Intelligence and Global Data Risk Signals.

Read Press Release

Check out our recent articles.

Harmonizing Risk: Why iGaming Needs a Unified View of Fraud Defence.

Fraud in iGaming has never been faster, nor more adaptive. Regulators now demand not only proof of customer due diligence but evidence of continuous monitoring and adaptive defences. Meanwhile, fraud rings exploit chargeback gaps, orchestrate bonus abuse, and scale multi-accounting with industrial precision. For operators, the challenge isn't recognizing the risks; it's unifying visibility of them across a single platform.

"Operators are dealing with threats that evolve daily," says Alfredo Solis, Managing Director of AcuityTec. "Defence has to be continuous, not fragmented. The future isn't about patching problems in silos, it's about one view, one source of truth."

AcuityTec and Greco Partner to Provide a Holistic View of Player Identity, Transactional Risk Screening, and Gameplay Intelligence.

AcuityTec, providing fraud defense, transactional screening, risk monitoring intelligence, and perpetual KYC (pKYC) solutions, today announced a strategic partnership with Greco, a leader in bonus abuse detection and gameplay risk analysis for iGaming. The collaboration unites AcuityTec's advanced transaction-level fraud and player verification intelligence with Greco's behavioral gameplay analysis, delivering a unified solution to combat bonus abuse, multi-accounting, and syndicate exploitation...

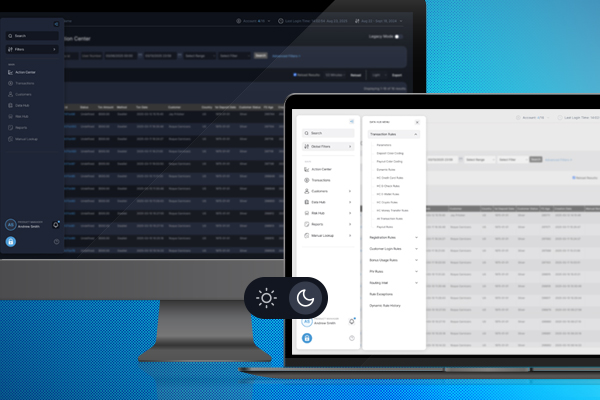

Read Press ReleaseAcuityTec Elevates Fraud Defense with a Modernized UIUX Experience, Expanded Data Intelligence and Risk Screening Tools.

AcuityTec, a leader in fraud defence, transactional risk intelligence, and perpetual KYC (pKYC) solutions, has unveiled a new wave of platform enhancements designed to transform how businesses manage identity, risk, and transactions in today's digital economy. More than incremental upgrades, these enhancements represent a significant leap forward in user experience and data intelligence, providing iGaming and Fintech platforms with the tools to stay ahead of sophisticated fraud threats while...

Read Press ReleaseContinuous Trust in Action: Perpetual KYC Meets Adaptive Fraud Defence Protection

Fraudsters today are more inventive than ever, stitching together entire identities from stolen credentials, forged IDs, and even deepfakes, making single source checks no longer an option for secure protection against fraud. Imagine weaving together insights from just a few touchpoints: a user's device fingerprint, geolocation, or phone profile; a quick match against government, credit bureau, or utility records; and a simple address, email, or SMS check. Then bolster that foundation with document verification of government issued IDs and a subtle liveness scan to combat deep fakes. By leveraging those signals...

Read ArticleReinforced Fraud Defense - We've raised the bar with powerful new upgrades that sharpen insight, accelerate decisions, and strengthen compliance.

As digital fraud continues to evolve, AcuityTec has unveiled a strategic expansion of its platform for greater resilience, precision, and operational clarity. With fraud losses expected to exceed $400 billion globally by 2027, according to Juniper Research, businesses urgently need tools that are both adaptive and scalable to defend against today’s threats...

Read Press ReleaseEnhanced Doc ID & Liveness Checks - AI-powered analysis with real-time risk scoring bolsters customer ID verification from onboarding, re-authentication to transactions.

Our newly bolstered document verification solution offers a robust, real-time method to verify government-issued IDs across LATAM markets, including passports, driver's licenses, and national identity cards. Backed by AI-powered analysis, their platform detects forged documents, tampering, and expired credentials while extracting and validating identity data through OCR...

Read Press ReleaseNext-Gen Enhancements - Bolstering Transactional Security and Customer Verifications.

We've launched a powerful expansion of our fraud prevention and compliance platform, introducing a range of enhancements that fortify transactional security, elevate customer verification, and streamline compliance. The latest advancements include an enhanced PhoneID verification suite, upgraded money transfer risk screen...

Read Press ReleaseEnhances Fraud & AML Orchestration Hub

Securing LATAM’s Rapidly Growing iGaming and Digital Payments Markets

LATAM’s betting market is set to triple its gross gaming revenue (GGR) between 2020 and 2025. Brazil, Mexico, and Colombia are driving this expansion, with Brazil alone contributing 50% of the region’s gaming revenue and projected to reach an annual turnover of USD 10 billion. Meanwhile, LATAM’s digital payment ecosystem is equally rapidly evolving, with Brazil’s Pix outpacing traditional payment methods. However, the rise in digital transactions and gaming activity has also escalated fraud risks, with iGaming fraud rates in LATAM significantly exceeding the global...

Read ArticleUnlocking Secure Growth

Empowering iGaming Operators with KYC & Adaptive Fraud Defense

The iGaming industry is a high-stakes world where security, compliance, and seamless player experiences define success. As operators push the boundaries of innovation, fraudsters and bad actors continue to evolve—exploiting gaps in identity verification, payment processing, and bonus abuse.

iGaming Industry Growth and Player Engagement

The iGaming industry has experienced remarkable growth in recent years, driven by technological advancements, regulatory changes, and shifting consumer behaviors. In 2024, the global online gambling market was valued at approximately $97 billion, reflecting a compound annual growth rate (CAGR) of 13.29% from $85.62 billion in 2023...

6 Emerging Fraud Trends in iGaming.

Combat them with streamlined and adaptive KYC and fraud defence.

The global iGaming market is projected to surpass $107.70 billion by 2025, with significant growth across Europe, North America, and Asia-Pacific. However, this expansion has also driven a surge in fraud, which increased by 64% year-over-year between 2022 and 2024. Sophisticated schemes such as account takeovers, credential stuffing, bonus abuse, and cryptocurrency-related money laundering are increasingly targeting operators...

Read ArticleGet Ahold of Your Fraud.

We discuss payment security with adaptive fraud defence, and perpetual KYC (pKYC).

As the global digital payments landscape expands, with projections to reach $16.59 trillion by 2028 at a CAGR of 9.52%, the need for robust fraud prevention has never been greater. AcuityTec addresses these growing threats by providing advanced payment verifications and fraud prevention solutions. Leveraging KYC data and technologies like machine learning, real-time transactional monitoring, and perpetual KYC (pKYC), AcuityTec empowers businesses to stay ahead of emerging fraud schemes while ensuring secure, seamless transactions without compromising user experience...

Read ArticleIntroducing Enriched AML: Strengthening Compliance with New PEP and Adverse Media Insights..

"Financial crime is evolving rapidly, and the regulatory environment is more demanding than ever. By expanding our relationship with ComplyAdvantage, we are giving our clients a significant advantage in maintaining a healthy and compliant portfolio—mitigating risks associated with politically exposed individuals, negative media coverage, and changing sanctions lists," said Alfredo Solis, Managing Director at AcuityTec.

Read Press ReleaseIntroducing AcuityTec CardTrust: Revolutionizing Credit Card Verification and Fraud Prevention.

We're proud to announce the launch of CardTrust, a groundbreaking product designed to streamline credit card transaction verification and combat fraud. By leveraging minimal customer data, CardTrust offers comprehensive security, significantly reducing the complexities and costs associated with KYC (Know Your Customer) procedures and ensuring secure transactions. CardTrust transforms the traditional approach to credit card verification by utilizing the BIN (first six digits of a card number), the last four digits of a card number, and a ZIP code. This innovative solution cross-references transaction data...

Read Press ReleaseIntroducing AcuityTec PayoutPro: Elevating Operational Integrity with Innovative Payout Solutions.

AcuityTec, a leader in modern fraud prevention and KYC platform, is excited to announce the launch of its AcuityTec PayoutPro, a specialized solution designed to optimize payout verification and risk analysis efficiency for the iGaming industry. Built on AcuityTec's proven transactional monitoring framework, PayoutPro integrates flawlessly to secure players and their associated payout transactions...

Read Press ReleaseNavigating the Future of Online Gambling Fraud Defense: Integrating KYC, Blockchain and Predictive Analytics for Faster and Adaptive Protection.

According to Straits Research, by 2030, the global online gambling market will reach $153B. As such, constant evolution in security and fraud defence in gaming is in continuous flux and requires agility and innovative methods to secure players and transactions seamlessly and confidently. Players' expectations of security over their gaming experience and deposits are at an all-time high; however, ensuring so in a frictionless manner is imperative not to impact player interest, conversions, and revenues...

Read ArticleWe've Amplified our Platform with Industry-Leading Enhancements to Combat Evolving Fraud.

We're proud to announce significant platform enhancements in data verifications and fraud prevention, designed to outsmart sophisticated fraudsters and empower superior transaction, customer and business fraud defence worldwide. This strategic upgrade introduces robust identity verification, further precision on fraud screening, and insightful analytics, reinforcing our leadership in safeguarding fintech operations...

Read Press ReleaseAnnounces Significant Strides In Business Growth and Innovation

In 2023, AcuityTec embarked on a transformative journey, enriching its product with various new features. Notably, they expanded their data hub by an impressive 18% with premium data services such as premium AML, advanced phone SMS services, and an enhanced PII digital identity verification solution. Furthermore, they bolstered their reporting and business intelligence capabilities, spanning transactional reports, registrations, risk scrubber performance, and predictive trend analysis intelligence.

Read Press ReleaseExpands KYC and Compliance AML data with ComplyAdvantage.

"Our partnership with ComplyAdvantage is more than just an integration; it's a strategic alignment of our vision to provide the most advanced data-driven compliance solution in the market with best-in-class data performance, results and coverage," emphasizes Solis. "At AcuityTec, we're committed to staying ahead of the curve and remaining a trusted partner for businesses worldwide with the most effective tools to automate risk screening, global fraud prevention and regulatory adherence."

Read Press ReleaseUnveils Innovative Platform Enhancements

"With these latest enhancements, AcuityTec is not just offering features; it's providing a strategic vision and unwavering dedication to equip businesses with the most advanced tools for KYC, compliance, and fraud prevention. In this rapidly evolving digital world, we strive to stand as a pillar of innovation and security, helping companies globally to stay ahead of risks and regulatory challenges with ease." states Alfredo Solis, Senior Director and Business Strategist.

Read Press ReleaseDon't Risk. Know.

We’re in a new era of fast-paced online financial engagements, with global digital payments expected to reach US $14.79 trillion by 2027. But that’s also opened a world for fraudsters to capitalise on businesses’ and customers’ vulnerabilities. Account takeovers, identity theft and other fraud have steadily climbed. As a result, customers expect best-in-class security to protect their online accounts and engagements, in addition to their increasing demands for 24/7 services and real-time transactions.

Make your online transactions safer, faster and fully compliant with fully customized perpetual KYC, advanced analysis and adaptive fraud defence.

Fintech Power 50.

We are proud to be listed in the Fintech Power 50 2024 guide - recognizing the fintech industry's most influential, innovative, and powerful figures.

"In an era where online transactions are not just the norm but rapidly accelerating, our vision at AcuityTec has always been to challenge the status quo in the fintech industry and provide cutting-edge, reliable and efficient fraud defence solutions. Being recognized as a part of the Fintech Power 50 is not just an honor; it's a validation of our commitment to innovation and excellence," states Alfredo Solis, Senior Director and Business Strategist at AcuityTec.

Combat AI-Driven Fraud with Automated Multi-Layered Defenses.

The digital landscape is in perpetual flux. With the rapid advancements in artificial intelligence and machine learning, the world has seen an unprecedented rise in sophisticated cyber threats. The process for fraudsters to create deepfake identity proofs to cunning bots and from artificial voiceovers to video avatars is becoming easier than ever. We discuss leading strategies on how to navigate these new threats with automated data and risk mitigation solutions.

Read ArticleThe Role of Machine Learning in Adaptive Fraud Prevention.

In today's digital age, the rise of online transactions has paved the way for a booming global digital payment landscape. We discuss 5 critical fraud prevention segments where data and technology synergy with automation. Leveraging multi-layered KYC with advanced risk algorithm intelligence and machine learning enables a complete adaptive fraud defence against old and new fraud threats.

Read ArticleData & Transactions: 4 Data-Driven Strategies To Bolster Transactional Monitoring.

In today's complex financial ecosystem, robust security hinges on deep data, Perpetual KYC (PKYC), real-time data risk analysis and leveraging leading technologies like orchestration hubs and machine learning. We dive into each of these strategies and how they foster a safer, more secure digital financial landscape that builds customer trust, loyalty, and revenue growth.

Read ArticleUnveils Transformative Platform Enhancements: Boosting Fraud Prevention Through Advanced Rules and Data Management.

These cutting-edge enhancements elevate risk management and streamline operations, showcasing AcuityTec's unwavering commitment to providing its clientele with state-of-the-art features tailored to the evolving needs of online fraud defence...

Read Press ReleaseAcuityTec Bolsters Strategic Leadership with New Senior Director, Alfredo Solis, Strengthening Commitment to Global Online Fraud Prevention.

With a 20-year career dedicated to bolstering online risk management, Alfredo Solis, brings passion and a wealth of expertise set to elevate AcuityTec's offering to Fintechs, crypto companies, iGaming platforms, and other online businesses worldwide to support our ever-growing online ecosystem...

Read Press ReleaseUnveils Brand Revamp to Underscore Our Commitment in Cutting-Edge Technology

The brand revamp marks an exciting milestone for AcuityTec, reinforcing its position as an innovative global leader and aligning perfectly with AcuityTec's trust, security, and innovation core values with contemporary, eye-catching, and sleek designs. The new visual representations of the brand reflect the company's growth, maturity, and dedication to providing unparalleled client services....

Read Press ReleaseBalancing Protection While Increasing Engagement for iGaming Platforms

Whether it’s sports betting, poker, or casino – they’re all contributing to a USD 81.08 billion market, estimated to grow at 11.7% CAGR surpassing USD 172.2 billion by 2030. Technological developments, increasing internet penetration, rising mobile phone usage amongst players...

Read MoreSecure Crypto Deposits and Payouts with Automated Crypto Analysis KYT Solutions

We have seen unprecedented growth within igaming/gambling markets globally. Even in a postpandemic world, the industry continues to experience high gains and will maintain its accelerated growth of 7.1% CAGR, to be worth $321 billion by 2026. Key contributing factors are an increase in overall global sports betting, high penet...

Read MoreGrow Your Fintech Business in Latin America With Leading KYC Digital Identity Data Verifications

Latin America is recently one of fintech’s hottest markets, providing a fertile ground for financial service adoption – potentiated by the high mobile app usage, subpar financial services, and the vast unbanked population. In 2021, the fintech venture and startup landscape reached $6B in investments in 2021, 3x more since 2020 and 24x more since 2016. Furthermore, governments have implemented fintech-friendly regulations such as Peru approved the Regulation of Innovative Models in 2021.

Read MoreEnsuring Trust and Security: The Importance of KYC/AML Compliance and Disclosure

Advances in technology have made it easier than ever to transfer money between people and organizations. Unfortunately, they’ve also made it easier than ever to transfer illicit funds illegally around the world. We discuss important compliance regulations and how through the combination of data-driven identity verification with an orchestration hub can elimiate the cumbersome process of remaining compliant.

Read MorePhoto Identity Verification: Remote ID Verification to Protect Your Business

In today's digitally connected world, online sales have become more crucial than ever before. However, while many customers embrace the convenience of online shopping, others may try to take advantage of it for their own gain. Credit card fraud and electronic theft are some of the common problems faced by businesses operating online. The most significant challenge is the ease with which dishonest individuals can steal someone else's identity and use it to make purchases online.

Read MoreCrypto and AML: What You Need to Know.

Cryptocurrencies have been making waves in the financial world lately, and for good reason. These digital assets are experiencing an unprecedented surge in popularity due to their accessibility and ease of use across national borders. As more people start using crypto for various transactions, it becomes increasingly important to ensure that these transactions are secure and compliant with regulations. This is where Anti-Money Laundering (AML) regulations come into play.

Read MoreFight Fraud with Device-Based ID and Machine Learning

Device-based authentication, commonly referred to as Device Fingerprinting, is becoming increasingly prevalent in today's market. With the rise in online fraud and cyber threats, businesses are turning to device fingerprinting as a valuable tool for preventing fraudulent activity. In a nutshell, device fingerprinting involves collecting unique information on a device, such as its configuration and settings, for identification purposes.

Read MoreHow to validate the status of a CPF number for Brazil?

The Cadastro de Pessoas Físicas (CPF; Portuguese for “Natural Persons Register”) is the Brazilian individual taxpayer registry identification, a number attributed by the Brazilian Federal Revenue to both Brazilians and resident aliens who pay taxes or take part, directly or indirectly, in activities that provide revenue for any of the dozens of different types of taxes existing in Brazil.

Read MoreChargebacks: A natural cost of doing business?

Many businesses used to accept chargebacks as an inevitable cost of doing business. However, this is no longer the case. Thanks to advancements in technology, chargebacks can now be significantly reduced or even prevented altogether. By taking the time to understand your business's needs and implementing the right fraud prevention measures, you can create a more controlled and secure environment. This not only gives you peace of mind but also frees up your attention to focus on other aspects of your business.

Read MoreKeeping up with Technology: Geolocation and Proxy Piercing

Geolocation is the practice of finding the geographic location of an object, usually an electronic device such as a phone or computer. Closely related to what a positioning system does, geolocation services focus on collecting data beyond the geographic coordinate (Proxy Piercing technology). Knowing where a customer is at the time of purchase is helpful to businesses, and geolocation services can be used for fraud prevention and regulatory compliance.

Read More